We always hear from hydropower industry, that energy of water is the cheapest to produce among all low-carbon generation technologies. However, from now on this would be a false statement. Recently we reported that, according to International Renewable Energy Agency hydropower installed in 2021 constituted less than 8% of all renewable capacity completed that year. One of reasons for falling out of favour – less competitive price per Kilowatt-hour produced.

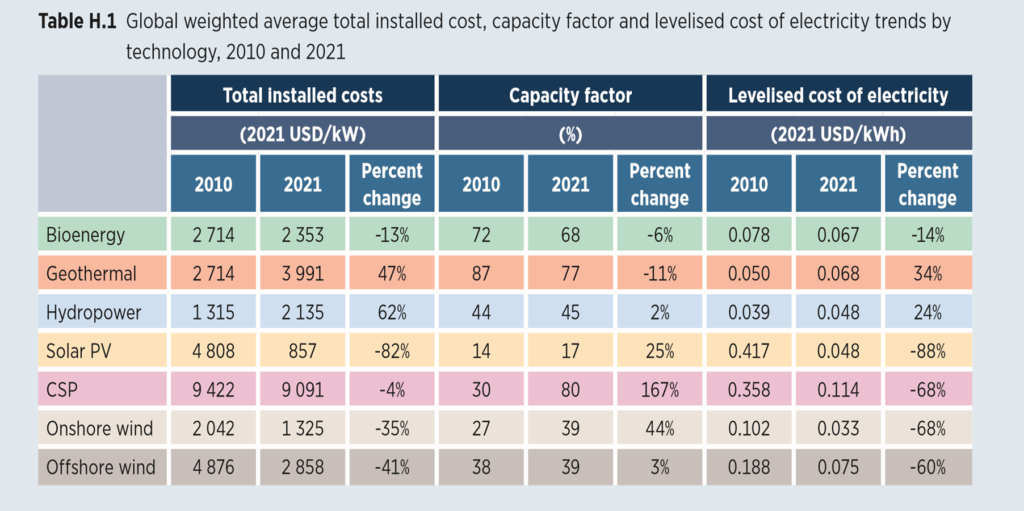

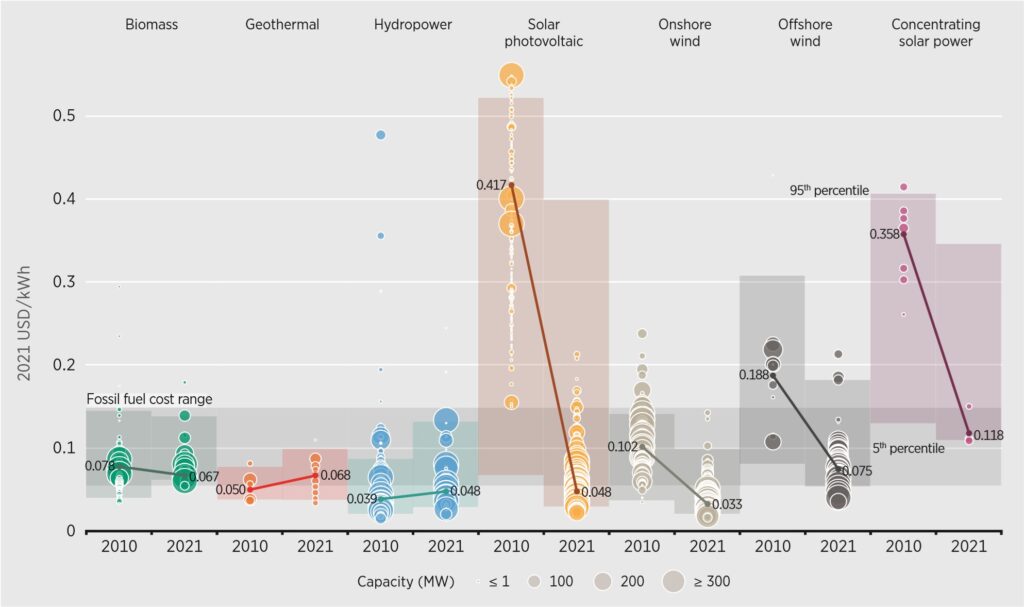

A new Report by IRENA on costs of renewable energy shows that despite turbulent markets prices of all renewables continued to decline, except for hydropower, CSP and geothermal. The global weighted average levelised cost of electricity (LCOE) of new onshore wind projects added in 2021 fell by 15%, year‑on‑year, to USD 0.033/kWh, while that of new utility-scale solar PV fell by 13% year-on-year to USD 0.048/kWh and that of offshore wind declined 13% to USD 0.075/kWh.

In a decade between 2010 and 2021 construction cost for PV power stations decreased by 88% and an average reached USD 857 /kW, while those for hydropower rose by 62% and reached USD 2135/kW. The cost of one kilowatt hour of energy produced by plants completed in 2021 was equal for hydropower and solar and much less for onshore wind.

It is equally important that in Europe cost of solar and wind generation fell far below of that for gas-fired and other fossil-fuel-based electricity generation option. Between January and May 2022 in Europe, solar and wind generation, alone, avoided fossil fuel imports of at least USD 50 billion.

HYDROPOWER HIGHLIGHTS

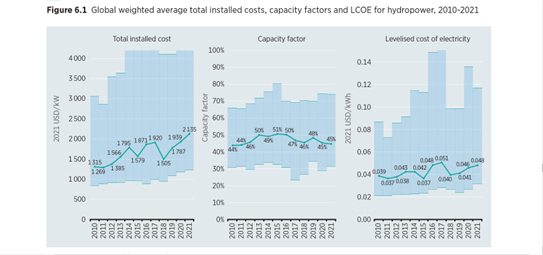

- The global weighted average LCOE of newly commissioned hydropower projects in 2021 was USD 0.048/kWh – 4% higher than that recorded in 2020 and 23% higher than the projects commissioned in 2010 (SEE Figure 6.1 from IRENA’s Report).

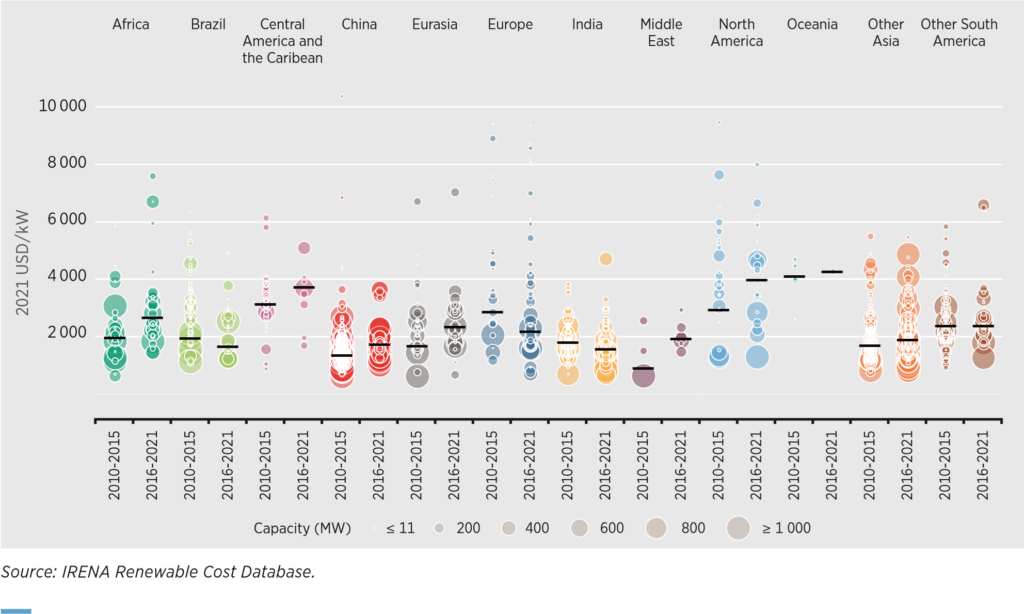

- The increase in LCOE of hydropower since 2010 has been driven by rising installed costs, likely due to an increase in projects in locations with more challenging site conditions.

- The increase in LCOE came despite the increased level of deployment occurring in China, which generally has lower-than-average installed costs; (According to IRENA, 15 gigawatts (GW) were installed there in 2021, compared to 12 GW in 2020.). Locations of dams for most of capacity added in China were the same as those in 2021 (e.g. new units of Baihetan mega-project), therefore spike in construction process cannot be explained by location. Therefore, we suggest, that it happened simply because Chinese government finally acknowledged that hydropower is not cheap to build. As we always pointed out, “average cost of construction” in China reported in previous years was much lower than in similar conditions in surrounding countries of Asia.

- Still 85% of the hydropower capacity commissioned in 2021 had an LCOE lower than the cheapest new fossil fuel-fired cost option.

- Given opposite trend in Variable RE and hydro, from now on hydropower construction and electricity production costs will be higher than that for most common solar and on-shore wind projects.

UNCERTAINTY AHEAD

Recent political and economic turmoil leaves little doubt, that bright renewable future is far from granted.

So far solar and wind are leading by wide margin as most economical renewable technologies. However, certain raw materials used in manufacturing of RE plants are also becoming more expensive. IRENA warns that, as not all of the materials cost increases witnessed to date have been passed through into equipment prices, the price pressures in 2022 will be more pronounced than in 2021 and total installed costs are likely to rise this year in more markets.

Source of all figures IRENA