Hydropower issues in the IEA report on “Reducing Cost of Capital”

The International Energy Agency issued an interesting report on reducing the cost of capital for “clean energy”, including hydropower. The Rivers without Boundaries considers it a timely publication in the era of rising interest rates, and is happy to suggest our comments and recommendations.

The report limits its scope with “emerging market and developing economies – EMDEs” – to exclude China from the development world statistics, as China alone invests in the RE sector twice as much as all other “EMDEs”. That is a valid focus, given that rising cost of capital disproportionately hits this group of countries.

The report “narrows its focus to specific high-priority sectors — utility-scale solar PV and wind, grid infrastructure, and energy efficiency in buildings — where reductions in the cost of capital can make a major difference.” We see progress in the fact that the IEA no longer sees hydropower as “the high-priority” sector in its own standing.

The definition of “hydropower” in this report “excludes output from pumped storage”, the actively developing which is also not considered in any other context. We consider it to be very strange given that pumped-storage is believed to have the highest value for “flexibility and security of power systems”. In 2022 the world witnessed 9 GW of new pumped storage and 5 GW came online in 2023 (predominantly in China), which shows renewed popularity of this technology.

The IEA assumes that in 2022 the investment in hydropower in EMDEs was less than USD 25 billion, but names no source for this figure. To the best of our understanding the report considers as adequate the current share of hydropower in “clean energy“ investment (7%), but call for overall energy investment in “EMDEs” to triple by 2035.

The Agency repeats the mantra that “In the NZE Scenario there is a fourfold increase in hydropower investment, driven by a dramatic rise in Southeast Asia and Eurasia, where hydropower plays an important role to replace the system services currently provided by thermal power plants.”

In our opinion this is not very accurate statement given already achieved high share of hydropower in those regions. Many states of Southeast Asia and Eurasia can use abundant hydropower plants that they already have to provide system services, while investing in diversification of their energy sources. The fact that hydro “in EMDEs meets the majority of electricity demand in 28 countries” seems not to be alarming for the IEA, while to us it clearly indicates dangerous overreliance on hydro .

The IEA recognizes that : “Many of the obstacles to future hydropower development are in the pre-development stage, with long permitting times and regular delays in construction presenting some of the major challenges to investment”. In our observation it is unavoidable feature of modern greenfield hydropower, which cannot b standardized, requires adjustment to unique local conditions and competes with many other societal needs for a scarce resource – water.

The Report notes “large untapped hydropower potential” (mentioning Africa example), but recognizes that “some countries that have historically driven capacity expansion, such as Brazil, spending has slowed due to the limited number of economically viable sites available for greenfield projects as well as opposition to large projects from affected communities.” That is the only mention of local communities in the report – they maliciously oppose timely hydropower installation.

The IEA estimates that “over half of all new hydropower projects in sub-Saharan Africa, Southeast Asia and Latin America are set to be either built, financed, partially financed, or owned by Chinese firms, benefiting from the advances the Chinese have been making in the hydro sector…The importance of bilateral finance from China, which is generally provided at attractive rates, and the challenges in identifying viable hydropower projects means that financing costs are not necessarily the primary obstacle to growth of the sector.”

We do not share the IEA’s optimism, as this important assumption may be wrong, once China decides to support overseas less risky and more popular technologies, like solar and wind as well as modern grid development. At least the volume of Chinese hydropower projects overseas that came on-line in 2023 is the lowest since 2014 (1500 MW in the RwB’s estimate), while overall capacity installed in 2023 by all EMDEs is estimated by IRENA at 4200 MW.

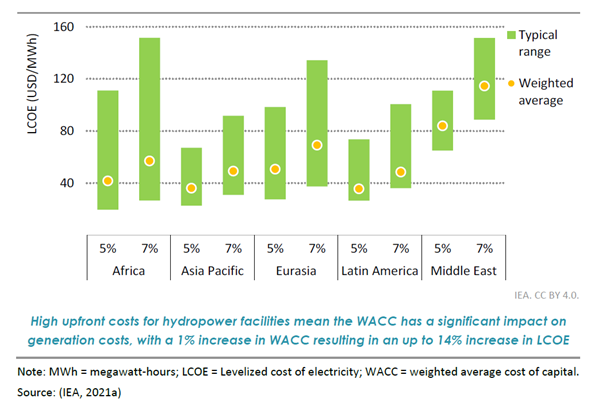

Most interesting are the following fears expressed by the IEA : “… given the high upfront costs to develop hydropower plants, the cost of capital can have a major impact on the LCOE. As a highly capital-intense technology, hydropower is particularly sensitive to the cost of capital. IEA analysis shows that an increase in the weighted average cost of capital (WACC) of one percent can result in a seven to 14 percent higher generation costs.”

On one hand, due to reliance on public finance and concessional loans, the hydropower nominally has lower cost of capital compared to privately financed commercial wind and solar (according to the IEA Report data). On the other hand, as cost of capital in growing globally it will present real large problem for competitiveness for cost of electricity (LCoE) produced by hydro, while it will be less of a problem for solar and wind power plants as those are already producing of the cheapest energy.

All in all IEA identifies the following “risks” for future cost of capital in hydropower sector:

• Permitting delays: Identifying viable sites and conducting environmental due diligence can cause significant delays to construction of dams

• Revenue risk: Many dams have multiple uses beyond hydropower plants, but these uses are not reflected in most business models

• Off-taker risk: Concerns over reliability of the off-taker.

In response the IEA suggests some generic solutions:

• Government: Improve long-term planning for hydropower projects, including site mapping with environmental data.

• DFI and government: Create robust, streamlined sustainability standards (meaning IHA standards) and monitoring procedures.

• Private(investors) and government: Ensure that business models reflect the multiple benefits of hydropower facilities.

They report also mentions less predictable weather patterns as a “Revenue risk”, but the authors did not include this item in the “risk-solution” table. Meanwhile, in our opinion, the first obvious no-regret solution would be to redirect capital towards modernization of existing hydropower assets to prevent loss and damage due to changing hydrology of rivers where they have been built. Many EMDE countries have sizeable hydropower fleet built in the middle of XX century, which urgently needs repairs and upgrades.

“Solutions” are not supported by any references to relevant research or guidelines, except for “sustainable hydropower” products marketed by International Hydropower Association, an industry lobbyist, which, probably, co-authored this chapter of the report.

CONCLUSION:

Despite clear weaknesses of such an approach the IEA still pushes for “quadrupling hydropower” and largely disregards environmental impacts, rights of local populations and public participation procedures.

At the same time the IEA is alarmed both with the long construction delays and with the vulnerability of greenfield hydro projects due to increasing costs of electricity production. The Agency still does not openly recognize that the lengthy development timeframe, which is unavoidable for utility -scale hydro is simply incompatible with climate targets. A large conventional hydropower plant for which responsible “site mapping with environmental data” starts in 2024, is very unlikely to come online before 2035 – a planning horizon of this IEA report.

Given that in 2023 new hydropower installation is hardly visible in global RE statistics, it probably high time to call on IEA to rethink their recommendations on the role of hydropower in their “Net Zero Scenarios”, as there are many more humane and environmentally friendly ways to achieve the same targets faster and in a more efficient manner.

See full IEA report here: https://iea.blob.core.windows.net/assets/227da10f-c527-406d-b94f-dbaa38ae9abb/ReducingtheCostofCapital.pdf